Markethive is engineered to deliver a comprehensive,

cohesive digital marketing framework, equipping modern entrepreneurs

with unparalleled reach and diverse opportunities, all seamlessly

integrated into the proprietary Markethive ecosystem. Key to this

approach are the currently integrated "Boost" system and the forthcoming

"Push" system. Together, the Boost and Push systems form a dynamic duo,

offering entrepreneurs a complete spectrum of digital marketing

capabilities, all managed and executed within the unified,

entrepreneur-centric Markethive platform.

These

systems, inspired by Facebook's Boost function, are a core element of

the Markethive ecosystem. They are designed to significantly amplify

your marketing reach among Markethive subscribers, offering immense

potential to boost brand awareness, drive conversions, and increase

engagement.

However,

Markethive operates on a principle of complete, organic reach,

fundamentally distinguishing it from the restrictive models of

mainstream social media platforms. Its standard news feed already

ensures that every one of your posts is delivered directly to the news

feeds of 100% of your friends and all members of your associated groups.

This core feature eliminates the artificial constraints and commercial

pressures that dominate other platforms.

Crucially,

Markethive is designed without the restrictive, often opaque algorithms

used by Facebook et al, which actively filter, suppress, and prioritize

content based on undisclosed criteria or paid promotion. At Markethive,

there is no underlying system that prevents your posts from reaching

your intended audience.

Furthermore,

the platform explicitly rejects practices such as "shadow banning,"

where a user's content is made invisible to others without their

knowledge. There is no third-party or proprietary system dictating or

censoring the content you can see, share, or engage with. This

commitment ensures a truly decentralized, transparent, and

high-engagement experience for all users.

The Push: Amplifying Your Message to New Members

The "Push" feature coming to Markethive provides a powerful,

direct channel to ensure your message reaches every new member who

joins the platform. This strategic placement guarantees maximum

visibility and immediate exposure for your content, establishing an

early connection with the platform's latest members.

How The Push works:

When

you utilize the Push feature, your message is prominently displayed to

all new members as they onboard into the Markethive ecosystem. This

means that, as soon as a new individual registers and logs in, your

communication will be among the initial pieces of content they

encounter. It also means new members will have an active newsfeed right

from the start.

Benefits of Using The Push:

- Immediate Exposure: Your message is seen by new members at the very beginning of their Markethive journey, making an immediate impact.

- Guaranteed Visibility: Unlike other posting methods, where content can be missed, the Push ensures your message is displayed to every new member.

- Strategic Onboarding:

Leverage this feature to introduce new members to your initiatives,

products, services, or community groups right from the start.

- Enhanced Engagement: By reaching new members early, you can encourage immediate engagement and participation in your offerings.

- Building Brand Awareness: Establish your presence and brand identity with new members from day one.

Crafting Your "Push" Message:

Given

the prime real estate your message occupies, it's crucial to craft

content that is concise, impactful, and clearly communicates its

purpose. Consider what you want new members to know or do immediately

upon joining Markethive. This could be:

- A welcoming message to your specific group or community.

- An introduction to a key product or service.

- An invitation to an upcoming event or webinar.

- A call to action for a free resource or download.

- An essential piece of information for navigating the platform.

By

strategically utilizing The Push, you can effectively amplify your

message and cultivate a strong, immediate connection with the growing

Markethive community. It ensures new members immediately see your

message upon registration, offering guaranteed visibility and immediate

exposure. It helps with strategic onboarding, enhanced engagement, and

building brand awareness by introducing initiatives, products, or groups

from day one.

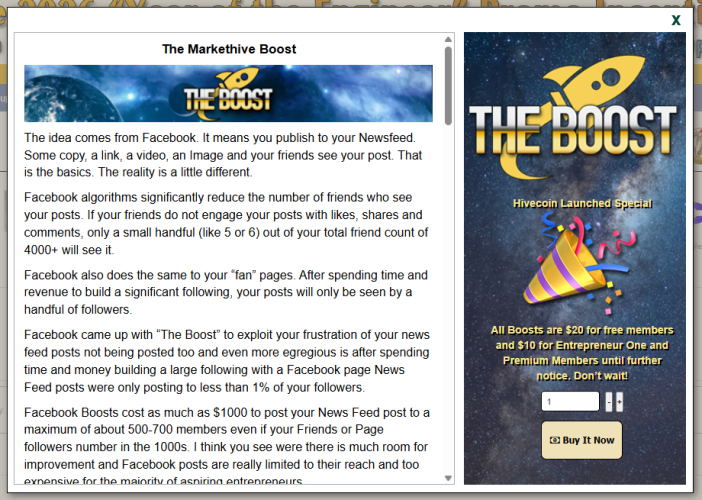

The Sales Page Pop-up

The Boost: Amplifying Your Message Across Every Member's News Feed

In today's hyper-connected yet intensely

competitive digital landscape, capturing and retaining audience

attention is the ultimate challenge. The sheer volume of information

being produced creates digital clutter, making it increasingly difficult

for critical communications to cut through the noise and achieve

genuine visibility. For organizations, businesses, and creators, this

often means that vital announcements, strategic updates, and high-value

content can be overlooked, diminishing their intended impact.

This

is precisely where the Boost steps in, offering a revolutionary,

unparalleled solution to systematically overcome these digital barriers.

It is more than a delivery system; it is a meticulously engineered,

proprietary mechanism built to guarantee content exposure.

How The Boost Works:

- Bypassing the Algorithm:

Unlike standard content distribution methods that rely on

unpredictable, often restrictive platform algorithms that frequently

filter, delay, or suppress messages, the Boost is designed to bypass

these bottlenecks entirely.

- Direct-to-Feed Delivery:

The core functionality of this feature is to ensure your content is

delivered directly to the news feeds of every member of your intended

audience. This is a non-negotiable guarantee of presence. Every eyeshot,

every scroll, will include your message.

- Catalyst for Impact:

As a powerful digital catalyst, the Boost dramatically enhances both

the visibility and the overall influence of your communications. It

transforms mere content posting into strategic, high-impact

distribution.

The Essential Benefits:

- Guaranteed Visibility:

Eliminate the risk of critical messages being missed. The Boost ensures

100% reach to the entire membership base, providing total confidence in

your communication strategy.

- Enhanced Engagement:

By ensuring direct exposure, the feature sets the stage for a

significant increase in readership, interaction, and subsequent action

from your audience. When people see the message, they can act on it.

- Maximum Impact:

Whether it is a product launch, a crucial policy change, an urgent

operational update, or a key community announcement, the Boost

emphasizes the weight and urgency of your message, making its importance

instantly clear and prompting immediate action.

By

utilizing the Boost, you transition from hoping your message is seen to

knowing it is delivered, cementing your place as a consistent and

authoritative source of information in the rapid flow of the digital

world.

Maximize Your Reach: The Unrivaled Power of The Boost

Imagine the impact of knowing

that every member sees your latest newsletter, a substantial policy

change, an exciting new event, or a crucial service update. The Boost

turns this vision into reality, making your communication strategy more

effective and your audience more informed. It empowers administrators

and communicators to deliver messages with confidence, knowing they will

be seen, absorbed, and acted upon.

In

essence, the Boost is more than just a publishing tool; it's a

strategic advantage that empowers you to communicate with unparalleled

reach and impact, fostering a more connected, engaged, and informed

member community. It serves as a PA system for communicating with the

entire membership, not just your friends and associates. If they like

your message and subscribe to you, you are then publishing to their

sphere of influence and social networks.

The

Markethive Boost feature is evolving to offer more targeted publishing

options, including the ability to publish to specific geographic

locations. Pricing will be tiered based on the delivery method, such as

targeting via hashtags, keywords, most active users, or number of

friends, but not via private navigation. The Boost feature will also be

incorporated into the Promo code incentive.

This allows you to offer it to prospects who join Markethive, as well

as to existing members who join your groups and make purchases in your

store.

Currently,

the Boost allows any post to appear on every member's News Feed for a

flat fee. For the launch period, the cost is $20 for free members and

$10 for Entrepreneur One upgraded members. These launch prices will

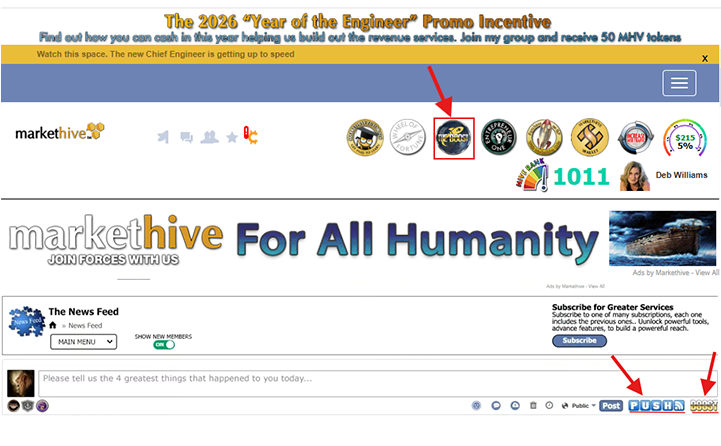

remain in effect until further notice. To get started, simply click the

Boost icon located in the top tray of the Markethive home page. A sales

page will pop up, allowing you to select the number of Boosts you want.

The Boost and Push icons will be displayed in the updated newsfeed under your editor.

An Epic Ecosystem In The Making

The Push and The Boost are subscription-based services that contribute to a much larger, multifaceted revenue-generating system

designed to establish a robust, resilient financial foundation. It

provides the predictable, recurring resources needed to support

long-term operational and iterative goals and key initiatives, such as

the ILP interest payouts.

The intensive iteration and development phase

for Markethive, our next-generation social commerce and marketing

platform, is progressing, bringing us closer to a fully operational and

revenue-generating system. However, to ensure a swift and successful

transition from development to full-scale launch, and to fully

capitalize on the foundational work already accomplished, additional

strategic funding is necessary.

This

crucial investment is not merely about maintenance; it is specifically

earmarked for the final, intensive development sprints required to

integrate advanced features, optimize the user experience, and

stress-test the platform under real-world conditions. Securing this

funding will directly enable us to:

- Accelerate Product Launches:

Bring key, highly anticipated features, such as the crypto exchange

listings for Hivecoin, a peer-to-peer marketplace, and advanced

marketing automation tools, to market much faster than currently

projected.

- Meet All Development Objectives: Fully

complete the Markethive platform's scope, ensuring a robust, scalable,

and secure system that can handle massive user growth from day one.

- Ensure a Polished User Experience:

Dedicate resources to final quality assurance, bug resolution, and user

interface (UI) refinements, guaranteeing a world-class experience for

all members.

By

contributing now, you are not simply donating; you are securing your

direct stake in the platform's future success and profitability. We

offer various contribution methods, some designed to give contributors a

significant, long-term stake in the Markethive ecosystem. Your support

will be the catalyst that transforms our current progress into a fully

realized, revolutionary market network platform ready to generate

substantial revenue. There are several ways to support us.

- Secure an E1 Subscription (New Members):

This is the ideal time to become an E1 member. A limited number of

non-expiring E1 subscriptions are available, securing your access to all

E1 benefits, including becoming an ILP shareholder and receiving 0.01

ILP annually, as long as your account remains active. Purchasing an E1

directly supports our development.

- Expand Your E1 Subscriptions (Existing Members):

Current E1 members can significantly accelerate product launches and

monthly dividend payments to ILP holders by purchasing additional E1

subscriptions.

- Direct Initial Loan Procurement (ILP) Purchase: Individuals

interested in a basic, direct investment in the platform's future can

buy an ILP separately. Please reach out to the Administration for more

information.

- Maintain Active Engagement: Your participation in the ecosystem is crucial. We encourage you to:

- Purchase Boosts and Vanity Promo Codes: These tools are essential for expanding your marketing reach and increasing conversions.

- Stay Active in the Wheel of Fortune Game: This activity helps boost system energy, increases transaction volume, and rewards your efforts.

Join

us as we move forward with the next-generation multidimensional media

platform, Markethive. Welcome to the Entrepreneur’s ecosystem. We are

built for Entrepreneurs by Entrepreneurs and are made up of

Entrepreneurs of every caliber.

Thank you for your ongoing support. God bless you.

.png)

.png)