The Know Your Customer (KYC) process is a crucial requirement

within the Markethive ecosystem and is essential for accessing the

platform's features and benefits. However, a growing faction of freedom

lovers who value autonomy and privacy, especially in the cryptocurrency

sector, has expressed reluctance to comply, citing concerns about

government overreach and the erosion of personal freedoms. This

viewpoint has merit and prompted Markethive to implement the KEY

Validation protocol, which differs significantly from current financial

industry practices.

This article outlines the legacy of KYC regulations in the financial industry and explains why the centralized cryptocurrency industry must now comply with these laws. Additionally, we highlight Markethive's innovative approach to this type of validation, outlining its distinct features and how it benefits both the individual and the broader community.

A Historical Look At The KYC Regulations

KYC regulations trace their origins to the 1970 Bank Secrecy Act (BSA) in the United States, enacted to combat money laundering. The global financial crisis of 2008 and subsequent regulatory reforms, along with heightened security concerns following the 9/11 attacks in 2001, have driven the development of stricter regulations aimed at preventing financial terrorism.

A robust Know Your Customer (KYC) framework for financial institutions requires verifying a customer's identity using personal details such as name, address, and identification documents. It also involves understanding the customer's intended activities, including the source and destination of funds, and evaluating the customer's potential money laundering risk by monitoring account activity.

Source: KYC in Crypto

KYC in the Cryptocurrency Sector

Regulators worldwide are increasingly focusing on the cryptocurrency industry. In 2019, regulatory bodies such as the SEC, FinCEN, and CFTC classified cryptocurrency exchanges as money service businesses (MSBs). Consequently, these exchanges must comply with the Bank Secrecy Act of 1970's KYC and Anti-Money Laundering (AML) rules.

KYC is required on almost all centralized crypto exchanges. By verifying a customer's identity, KYC in crypto aims to prevent illicit activities such as money laundering, terrorist financing, and tax evasion. While some exchanges may allow account creation before KYC is completed, these accounts typically have limited functionality until the verification process is finalized.

Various exchanges have different procedures for customer verification. Some may restrict activities such as buying cryptocurrency or withdrawing funds until KYC is completed, while others may impose deposit limits. KYC requirements vary across crypto exchanges but typically involve providing personal details, including full name, date of birth, address, and a government-issued ID, such as a driver's license or passport. Some also request additional identification, such as a utility bill and a selfie with your ID details and signature.

The inherent characteristics of a decentralized economy, often found in the crypto industry, conflict with the principles of KYC regulations. Decentralized systems are designed to enable users to maintain their anonymity and keep their personal data confidential, shielding it from centralized oversight. As a result, many cryptocurrency companies are unable to verify their customers' identities.

However, regulators have become increasingly dissatisfied with the status quo, prompting even the most resistant cryptocurrency exchanges to implement stricter KYC protocols despite concerns about user anonymity, in response to mounting pressure from authorities.

Notably, decentralized exchanges (DEXs) are currently exempt from Know Your Customer (KYC) obligations. This exemption applies to any entity that facilitates trades through self-executing smart contracts, thereby bypassing traditional centralized trading platforms. As a result, these platforms are not bound by existing regulatory frameworks because they do not act as intermediaries or counterparties in transactions. Instead, users interact directly with one another via the DEX's infrastructure.

.png)

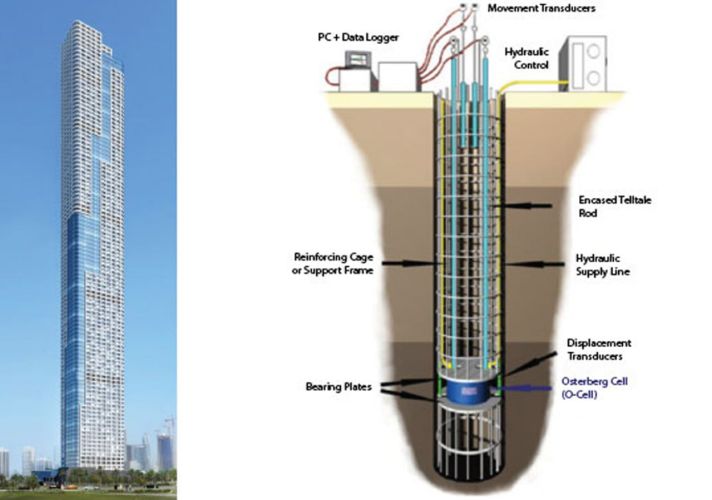

Markethive’s KEY Validation Is Unique.

Markethive is a pioneer in decentralized social media, inbound marketing, and broadcasting networks within the crypto industry. Its ecosystem is driven by its crypto, Hivecoin, which individuals in the Markethive community hold in their portfolios and use for transactions and commerce. Moreover, as with all transactions, dividend/interest payments from the Initial Loan Protocol (ILP) to Entrepreneur One (E1) associates are credited to their Markethive wallets, making them valuable and opportunistic for nefarious activities; hence the need for the KEY Validation protocol.

Markethive is in a fortunate position and has found a solution to the pervasive overreach of so-called governing bodies’ prying eyes into what should be our financial autonomy. Markethive's KEY Validation approach is distinct, innovative, and independent of government oversight.

Unlike traditional regulatory requirements, our protocol prioritizes user autonomy and confidentiality. We don't share your information with government agencies or regulatory bodies, ensuring your data remains private and secure. We prioritize your privacy by keeping all data and transaction records safe within Markethive's highly sophisticated vault, which also serves as your cryptocurrency wallet and financial accounting system.

Markethive operates on a dual principle: Reach and Return = R². This indicates that Markethive offers robust broadcasting capabilities alongside tools to cultivate customers, clients, and leads, ultimately delivering significant returns on your investment, time, and qualification.

The key distinction of Markethive from other platforms is its secure, distributed environment, where everyone is verified through the KEY protocol. This KEY system serves as a Qualification that boosts the returns on your efforts, work, and investments. In contrast, Markethive’s à la carte subscriptions offer enhanced broadcasting capabilities, resulting in a broader presence and greater reach across the internet.

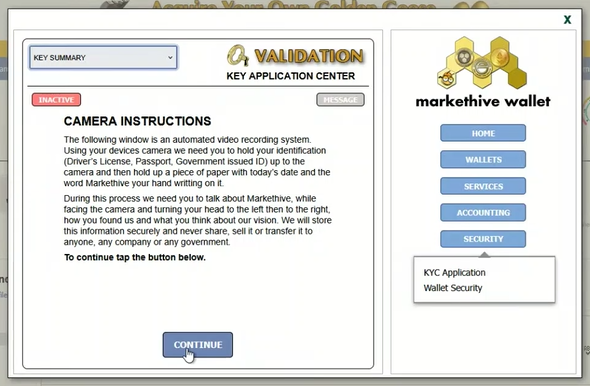

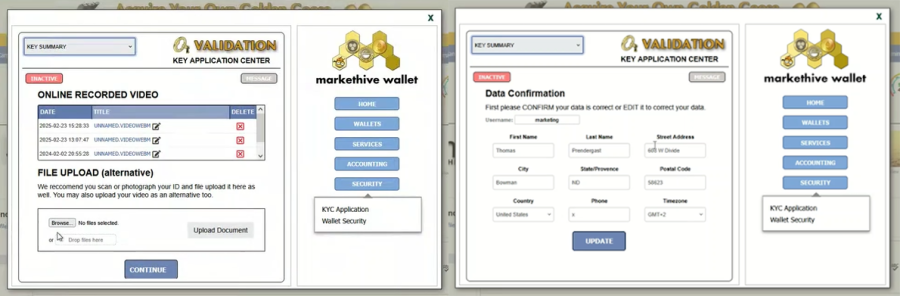

The built-in recording apparatus in the Markethive Vault in the Security tab

Initiating Your KEY Qualification

To verify your identity, the primary KEY is a brief video that includes a recording of your chosen form of ID (e.g., a driver's license), a handwritten note citing Markethive, the date, and your signature, along with a personal introduction and a short explanation of how you discovered Markethive or what motivated you to join. You can easily record this video directly within your Markethive vault, which has a built-in recording feature.

The camera activates only when you press “Start Recording," giving you ample time to prepare. This feature is beneficial. Your brief selfie videos are encrypted and securely stored in the Markethive database and are used solely for account recovery.

The stored video can verify your identity if you misplace your device, and the 2FA app is required to access your Markethive wallet or other 2FA-enabled services. To regain access, simply create a new video explaining the situation and requesting account restoration. An external support messaging service will be designated for this process.

Once you've uploaded the video, please verify your name, address, and phone number on the Data Confirmation screen. Your address allows us to send you exciting Markethive merchandise, including hoodies, coffee cups, and even physical Hivecoins!

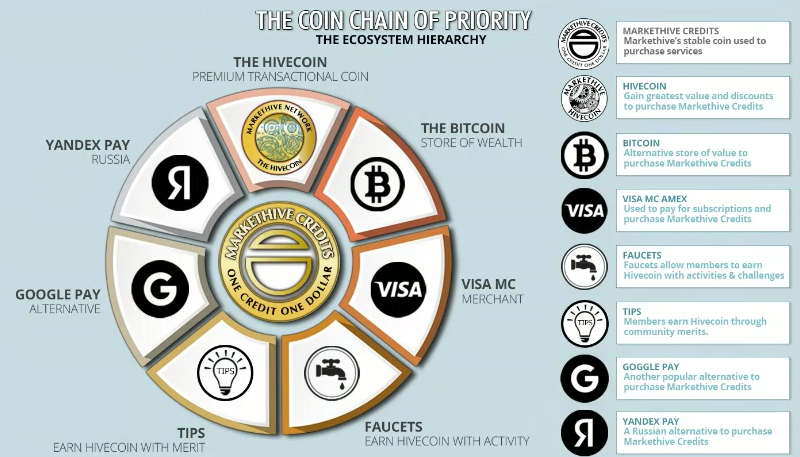

The video and the credit or debit card payment method for your selected KEY level will be sufficient for identification; no further official documents are required. However, you can upload a document if you wish. Alternative payment options, such as Google Pay and Yandex Pay, will be accepted for those without a traditional payment card, or you can fund your account with BTC.

On the Markethive platform, users can opt to maintain their anonymity by using a pseudonym and avatar. However, the platform's Hivekey Validation verifies their identity behind the scenes. A key badge on their profile publicly indicates their KEY-verified status, so members will know they have completed the Hivekey Validation protocol and are genuine.

By incorporating a video recording and upload feature in the Markethive vault, enabling 2FA, and using Social Network OAUTH during initial registration on the Markethive platform, we help ensure authentic individuals. This multi-layered verification process ensures genuine individuals interact on the platform rather than fake or fraudulent accounts.

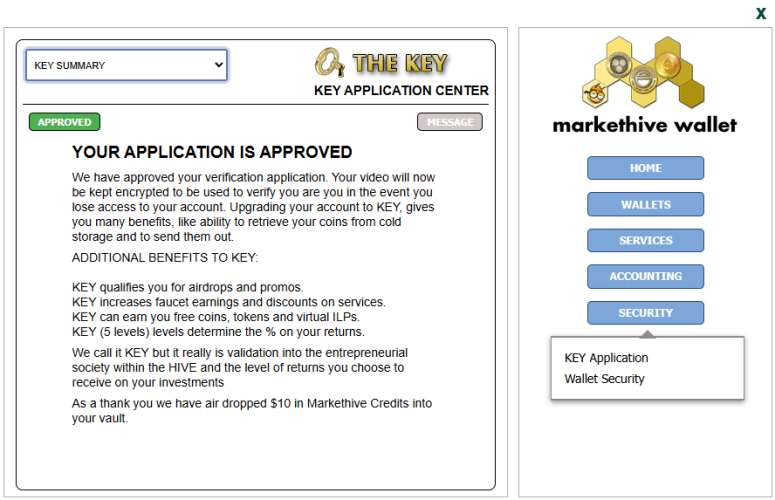

The KEY Application Center

The Markethive ecosystem for entrepreneurs is fueled by its crypto, Hivecoin (HVC). Whether you're new to the crypto industry or a seasoned crypto enthusiast, you have a variety of avenues to explore when looking to acquire HVC tokens.

Markethive has implemented a unique, tiered qualification system that allows members to choose from the various eligibility levels by purchasing a qualification package. This initial purchase serves as a gateway into the HVC ecosystem. Depending on your chosen package, you unlock multiple benefits, including airdrops and bonuses that grant additional HVC tokens. The more you invest in your qualification, the more benefits and tokens you receive, creating a system that rewards long-term engagement and commitment.

The KEY Qualification Levels

Beyond the free options like “NonKee” and "Freebee," Markethive provides five different entry levels. Once approved, each paid level confirms your account and grants you access to various rewards and thank-you bonuses. Importantly, your selected KEY level activates the micropayments system and determines the value of the rewards you receive.

The value you receive from the KEY Validation process at all levels far outweighs the cost. It is an excellent way to kick-start your entrepreneurial journey with Markethive and acquire Hivecoin and ILPs. The two top levels essentially render you a shareholder, where you receive a significant portion of Markethive’s net revenue paid monthly into your wallet.

.png)

NonKee: $0.00 / No KEY Validation limits.

NewBee NonKee. Limited words per News Post. Limited words in comment

posts. No access to marketing tools. Entry restrictions to Super Groups.

No airdrops, no Promo Code drops.

- No yearly Markethive Credit drops.

- No access to marketing tools

- No faucet micro payments

- Limited News Feed Posts

- No Hivecoin Wallet access

FreeBee: $0.00 / Video validation required and approved.

Activates all Inbound tools, Profile Page image upload, blogging, etc., for 30 days.

- 5 MHV tokens bonus on new referrals

- No Hivecoin yearly bonus

- No Markethive Credits yearly

- Free Automated Tools for 30 days

- 1% of faucet micro payments for 30 days

- Unlimited News Feed Posts

- No Hivecoin Wallet access

Copper: $5 / Yearly - Pay via CC or Crypto

- 10% matching bonus for all future sign-ups

- $1 in Hivecoin yearly bonus

- $10 Markethive Credits yearly

- 10% of future Coin Airdrops

- 10% of future Promo Code Drops

- 10% of faucet Micropayments

- Activates Limited Cold Storage access

- Activates Wallet Sending Feature (Limited)

Nickel: $50 / Yearly - Pay via CC or Crypto

- 25% matching bonus for all future sign-ups

- $10 in Hivecoin yearly bonus

- $100 Markethive Credits yearly

- 25% of future Coin Airdrops

- 25% of future Promo Code Drops

- 25% of Micropayments

- Activates Cold Storage access

- Activates Wallet Sending Feature

Silver: $500 / Yearly - Pay via CC or Crypto

- 50% matching bonus for all future sign-ups

- $100 in Hivecoin yearly bonus

- $500 Markethive Credits yearly

- 50% of future Coin Airdrops

- 50% of future Promo Code Drops

- 50% of micro Payments

- Activates Cold Storage access

- Activates Wallet Sending Feature (Unlimited)

Gold: $5,000 / 5-yearly - Pay via BTC only

- 100% matching bonus for all future sign-ups

- $1000 in Hivecoin yearly bonus

- $1000 Markethive Credits yearly

- 100% of future Coin Airdrops

- 100% of future Promo Code Drops

- 100% of Micropayments

- Receive 1/10th ILP

- Activates Wallet Sending Feature (Unlimited)

Platinum: $50,000 / Legacy - One-time payment - Pay via BTC only

- 200% matching bonus for all future sign-ups

- $20,000 in Hivecoin yearly bonus

- $2,500 Markethive Credits yearly

- 200% of future Coin Airdrops

- 200% of future Promo Code Drops

- 200% of Micropayments

- Receive 1 ILP

- Activates Wallet Sending Feature (Unlimited)

Achieving a higher qualification status offers a greater return on your investment. Furthermore, it can reduce costs associated with your Markethive product and service subscriptions, thereby significantly expanding your reach. The annual KEY protocol is the process used to confirm member status. Ultimately, you are free to choose the KEY level for your ongoing qualifications.

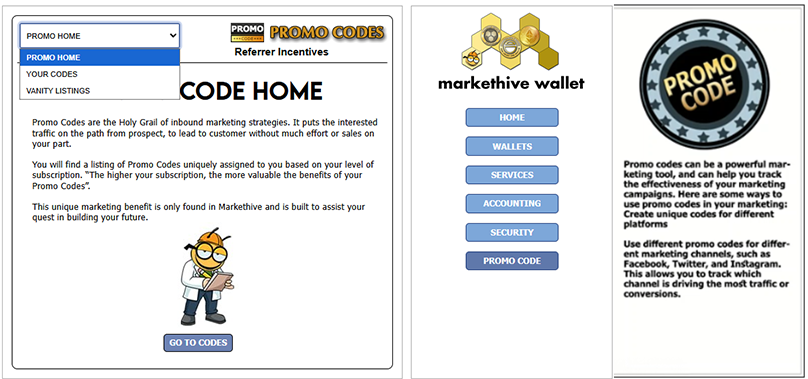

The Promo Code Reward System

An added bonus is the Promo Code reward system, unique to Markethive. The KEY login process serves as a gatekeeper, allowing everyone to enter Markethive. However, to unlock the full potential of the Promo Code rewards, users must complete the KEY Validation process, confirming their authenticity as community members.

Upon joining Markethive via a referral link with a Promo Code, new members receive a complimentary package of exclusive benefits and perks. This welcome bundle may include complimentary Wheel of Fortune spins, free Boosts, a 30-day trial of the Premium Upgrade, banner impressions, Markethive Token Airdrops (MHV), or a redeemable value of Markethive Credits (MHC).

After registering with the provided Promo Code, users will be prompted to complete the KEY Validation process at their first Markethive login to unlock the benefits associated with the Promo Code. New users have a 30-day window to complete the KEY validation process and will receive reminders at each login.

Completing this protocol unlocks a range of exclusive products and services, enabling new members to experience the platform's diverse offerings. This innovative approach benefits both the individual and the broader Markethive community. Certain Promo Code offers include referral incentives, where the referrer can earn matching bonuses.

After approval, a pop-up will show you the benefits of the Promo Code. It will also indicate your entry level and outline the bonuses available for micropayments and airdrops.

Conclusion

In summary, Markethive is about building a robust, genuine environment that rewards the community for active participation. By completing the KEY Validation process, members are verified as real individuals, ensuring a secure environment for communication, social interactions, and business interactions within the Markethive platform.

The purpose is to create an active, dynamic, and secure “hive of people” with an entrepreneurial spirit, both in the entrepreneur set and its subsets, fostering a culture of positivity rather than negativity and dishonesty. This community is characterized by love and stands in stark contrast to the current fear-driven society.

It is not the “cancel culture” prevalent on legacy social media, but a meritocratic, autonomous culture with a sense of humor where everyone enjoys what they do, far removed from the oppressive tyranny that has engulfed the world. We are a community dedicated to seeking and proclaiming the truth, guided by a Divine vision that empowers us to build a strong economic framework. This framework enables us to overcome the forces of elitism and oppression.

Markethive

has achieved a unique balance between confidentiality and openness. Our

secure vault protects your verified identity and offers an avatar

feature to maintain your anonymity on public newsfeeds. Meanwhile, our

blockchain-based, cryptocurrency-powered ecosystem ensures a transparent

and trustworthy economic environment.

.png)

.png)

.png)

.png)

.png)

.png)

.png)