Markethive is more than an online platform; it is a transformative movement that empowers entrepreneurs and addresses the problems of centralized control in traditional social media and broadcasting. This innovative project is an ecosystem designed to restore the essential autonomy and freedom of speech necessary for independent journalism, authentic social engagement, open dialogue, and efficient online business operations.

Through its comprehensive and holistic approach, Markethive strives to unlock human potential and build a strong, resilient community. Its goal is to motivate entrepreneurs to achieve exceptional success and make a positive impact in their respective industries, enabling them to thrive amid global challenges. Central to this mission is the Markethive financial system, powered by its native cryptocurrency, Hivecoin, which ensures the ecosystem's autonomy and establishes it as the ultimate resource for entrepreneurs.

The Markethive Foundation: Engineered for Endurance

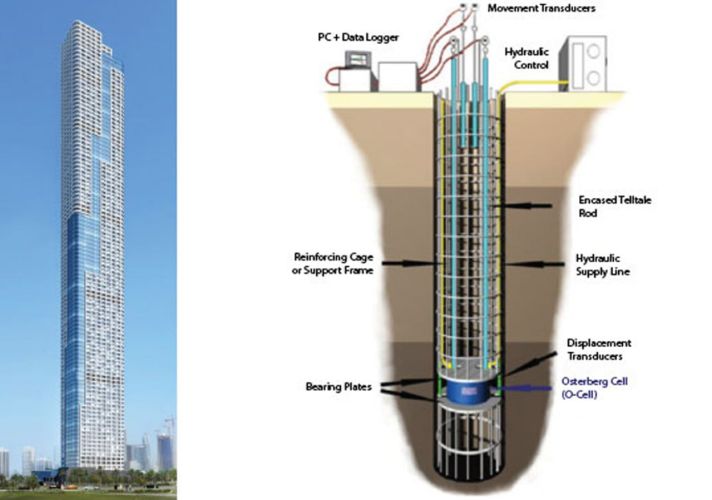

The most critical and time-intensive stage of any ambitious construction project, such as a modern skyscraper, is not the vertical ascent but the foundation work. Establishing a robust base often takes significantly longer than the initial above-ground construction. This deliberate, lengthy process involves meticulous geological surveys, deep piling, and extensive concrete work, all non-negotiable steps to ensure the structure can permanently bear an immense load and withstand environmental challenges.

Markethive has adopted this methodical, long-term commitment as a core strategy, focusing solely on building a deep, solid architectural foundation over several years. This strategic approach ensures the platform is structurally sound and engineered never to crumble or fail, particularly as it navigates the profound volatility and turbulence of today's precarious geopolitical and socioeconomic climate.

What distinguishes Markethive is its pioneering integration of revolutionary new technologies, specifically blockchain, with an entirely new decentralized financial system. This system incorporates its own native cryptocurrency, Hivecoin (HVC), designed to deliver essential benefits for its users:

- Restoration of Personal Privacy and Data Autonomy: Giving users back control of their information.

- Enablement of Financial Sovereignty: Providing independence from centralized control.

- Sustainable Wealth Generation: Creating an environment of success where centralized systems are increasingly failing or becoming untrustworthy.

By mirroring the careful, years-long foundational work of a skyscraper, Markethive is building a perpetual-motion ecosystem. It is engineered for resilience, user empowerment, and enduring success. This article will explore the foundational core of Markethive, examining its values, purpose, and the integral features and tools including those currently under development, that define the Markethive ecosystem.

The Markethive Ecosystem: Core Values and Purpose

Markethive is a pioneering, decentralized platform leading the Internet's third wave by prioritizing user autonomy and challenging traditional centralized models. It functions as a comprehensive universal social marketplace, seamlessly integrating features for:

- Social Networking and Content Broadcasting: Building community and sharing information.

- Inbound Marketing and E-commerce: Driving business growth and sales.

The platform is fortified with AI Silos to significantly enhance creativity, communication, and business operations, making it highly accessible and intuitive for everyday entrepreneurs.

Vision and Ethos:

Inspired by a divine vision, Markethive is engineered to disrupt existing business paradigms and cultivate the independent "cottage industry" spirit. Its community culture is built upon the foundational values of:

- Financial Independence

- Free Self-Expression

- Privacy

- Meritocracy

- Autonomy

Operational Structure and Integrity:

Markethive operates as a self-regulating, community-supported ecosystem. It employs limited AI primarily for security in its rating and reputation system, which is augmented by Human Intelligence (HI) to ensure fair, merit-based interactions among all users. Crucially, as the platform has grown without significant venture capital investment, its financial success and accumulated wealth are shared directly with its members.

Empowering Entrepreneurs:

Markethive provides a supportive, nurturing environment that fosters the creation of constructive, valuable content that encourages critical thinking and personal development. Entrepreneurs gain a powerful global launchpad to showcase their ventures, expand their online presence, and access multiple revenue streams, including:

.png)

The Decentralized Foundation of the Markethive Ecosystem

Markethive's core differentiator is its unique, decentralized architecture. The platform is evolving into a vast, distributed database system, underpinned by a robust blockchain infrastructure that intelligently combines the strengths of two separate blockchain layers. This design ensures extreme scalability, capable of supporting an enormous user base, potentially exceeding hundreds of millions, and managing massive volumes of creative content. This entire system is supported by a global network of strategically located servers.

To ensure true decentralization and reliability, Markethive is replacing unreliable APIs and deploying multiple servers globally to support its mining hives. These "hemp servers" will be strategically located on sovereign lands, such as Indian reservations in the United States, where they will dual-function as both greenhouses and server farms. These servers are integral to the coin-mining operation, generating profits for Markethive community members involved in these projects.

Implementing this architecture will make Markethive impervious to negative external influences. The Markethive World Data Chain consists of numerous servers that continuously communicate and synchronize with one another across the entire blockchain network. This redundancy ensures uninterrupted data transmission and service for Markethive users, even if a single server experiences downtime.

Ultimately, this comprehensive solution guarantees financial decentralization and complete autonomy. It safeguards intellectual property, creating an impenetrable fortress against the current digital landscape, which is often plagued by fraud, scams, data harvesting, political bias, and a dystopian environment.

.png)

The Markethive Ecosystem: Features and the Role of Hivecoin (HVC)

Markethive is a comprehensive platform distinguished by its internal wallet, advanced security, and its native digital currency, Hivecoin (HVC). With a fixed supply of 100 million units, HVC has a relatively low supply, positioning Markethive among the top 5% of cryptocurrencies and helping achieve a sustainable supply-demand balance.

Hivecoin (HVC): The Ecosystem's Native Currency

Hivecoin (HVC) is the core transactional cryptocurrency for the Markethive platform, where it is traded and listed on public crypto exchanges. IndoEx Exchange is the first platform to offer free market trading for HVC. The design of Hivecoin promotes continuous circulation, as users can earn and accumulate it through several methods within the Markethive ecosystem:

- Platform Activity: HVC is earned through daily participation on the platform via micropayments.

- Automated Distribution: Users can access HVC via Hivecoin Faucets.

- Merit-Based Rewards: Receiving HVC through the Tip Feature when other users value and appreciate their content.

- Investment & Staking: Earnings are generated through Incentivized Loan Procurement (ILP) and by staking Markethive Credits.

- Business Opportunities: HVC is accumulated by leveraging the various entrepreneurial ventures available within the ecosystem.

The Highly Sophisticated Markethive Wallet

The Markethive Wallet acts as the platform's financial operating system, integrating unprecedented levels of security. It is composed of multiple sub-wallets that handle specific functions:

- Accounting and Tracking

- Vault and Staking System

- Payments and Rewards Processing

- Integrated Crypto Support: Includes dedicated wallets for Hivecoin, Bitcoin, and Solana.

- External Gateway: Provides access to crypto exchanges and third-party wallets.

- Platform Services: Offers access to various Markethive products and subscription services.

Comprehensive Markethive Tools and Services

Markethive

is a fully operational, multifaceted platform that is constantly

refined through iterations and UX enhancements. It acts as a trailblazer

by seamlessly converging diverse social media channels and a

cutting-edge marketing automation system into a powerful, single

broadcasting hub. The core features include:

Core Marketing and Technology Tools:

- Inbound Marketing System: Tools for content creation and blogging.

- Page Making System (The Sitemaker): For building custom web pages.

- Smart Email Autoresponders: Automated Intelligent email communication.

- Search Engine Optimization (SEO): To improve visibility.

- Backlinking System: For enhancing search rank authority.

- Tracking and Analytics System: Essential for optimizing marketing strategy.

- Digital Broadcasting Capabilities: For wide-reaching communication.

Community and Business Development Features:

- Social Network Interface: A platform for connection and interaction.

- Super Groups: Dedicated spaces for business facilitation and community building.

- Customer Acquisition and Lead Generation: Focused tools for business expansion.

- Promo Codes: To incentivize and track promotions.

- The Swarm: Conference rooms for meeting and collaboration

Future developments will incorporate multiple feeds, mirroring popular platforms:

- X (formerly Twitter): A microblogging feed.

- YouTube: A video feed.

- Google Blogger: A blogging feed.

- Scoop.it: A content curation feed.

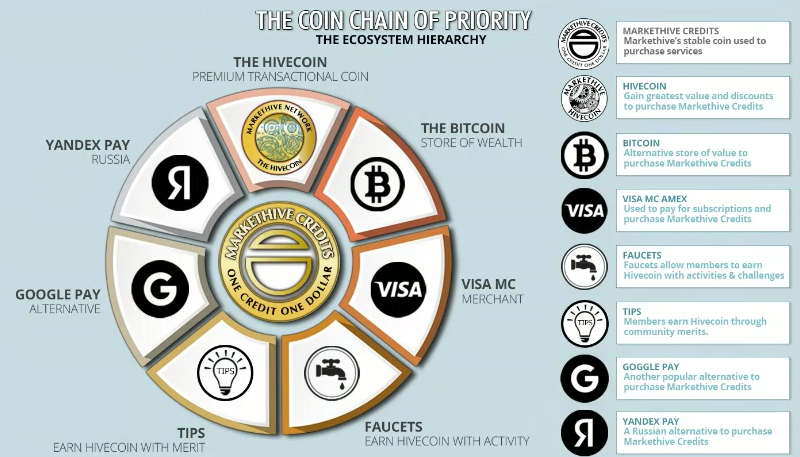

Related article: The Markethive Coin Chain of Priority - The Ecosystem Hierarchy

The Markethive Financial Core: Markethive Credit (MHC) and Hivecoin Utility Token (HVC)

The Markethive “token of commerce” is the Markethive Credit (MHC). Functioning as a stablecoin, MHC maintains a fixed $1 value and is used to purchase subscriptions, products, and services across the platform.

MHC is also central to the Markethive staking system. The interest a user earns daily is directly linked to the amount of MHC they hold in their wallet, with larger holdings yielding higher rewards.

Interest rates are influenced by various factors, as detailed in the accompanying illustration below. Accrued interest is paid out in Markethive Tokens (MHV) at the start of each month. Users can view their MHV balance in their coin clip and review the details in the Accounting section of their wallet.

It is important to note the conversion rate: 1 Hivecoin (HVC) is equivalent to 200 MHV, or conversely, 0.005 MHV equals 1 HVC.

.png)

Hivecoin (HVC) is more than just a coin; HVC is a versatile utility token essential for various functions within the Markethive ecosystem, including exchange transactions, payment processing, smart contract execution, and commerce token integration.

Crucially, Markethive issues HVC as a reward for users who engage with and use its platform's products and services, not as a means of fundraising. This approach provides Markethive with a significant advantage, as it has already established a fully functional ecosystem. In contrast to the traditional Initial Coin Offering (ICO) model, where funding often precedes development, Markethive can deliver on its commitments from the start.

Hivecoin's value is therefore grounded in its real-world utility and widespread adoption, rather than mere speculation. Its versatility is fueled by a range of in-demand products and services tailored for entrepreneurs and businesses. These offerings encompass a range of use cases, including publishing, sponsored articles, press releases, broadcasts, banner ads, video ads, and digital advertising across channels such as cryptocurrency faucet sites, news sites, the Boost platform, and the upcoming Push platform.

Furthermore, Hivecoin will significantly impact Markethive's gamification strategy, contributing to the overall growth and development of the Markethive ecosystem. This demonstrates that Hivecoin serves as more than just a means of storing value; it also operates as a practical utility token.

A significant benefit of using Hivecoin is the substantial discount on Markethive services. Users can purchase $1 in Markethive credits for just $0.80 in Hivecoin. For example, a $100 product or service can be purchased for $80 in Hivecoin. This incentive is designed to encourage the use of Hivecoin to acquire Markethive Credits, thereby fostering higher transaction volume on exchanges and boosting demand.

The current value of Hivecoin is tracked by a dynamic ticker that instantly calculates and displays the equivalent cost of a product or service in HVC in real time. Please note that this discount applies only to transactions made with Hivecoin. It does not apply to other cryptocurrencies, such as Bitcoin, or to standard payment methods, including credit and debit cards.

The Perfect Balance: Markethive's Thriving Ecosystem

The vitality of the Markethive crypto ecosystem is rooted in its dedicated community. While Hivecoin's utility and Markethive's resources are essential, the collective efforts and enthusiasm of dynamic community members are crucial drivers of the coin's supply. Users can acquire Hivecoin (HVC) through various methods, including faucets, tips, promo code giveaways, staking, ILPs, or by purchasing it on a cryptocurrency exchange.

Markethive achieves a balanced system through components that necessitate payment in Hivecoin, systems that generate Hivecoin, and the facility to trade Hivecoin on a crypto exchange. Leveraging cryptocurrency and blockchain technology, Markethive has pioneered an innovative platform that is charting a new course in the digital media industry.

This platform fosters a collaborative environment that recognizes and rewards contributions aligned with shared goals. By harnessing the collective energy of like-minded members, Markethive cultivates a thriving ecosystem that enriches its participants and positively influences the wider communities they engage with. This innovative approach is poised to revolutionize both personal and professional lives, opening up unprecedented opportunities.

Markethive has become a groundbreaking social market broadcasting network, the ultimate market network, providing people with economic independence, uncensored expression, privacy, and control. This change marks a new era of decentralized communication, in which the risk of "cancel culture" is significantly reduced.

(25).gif)